Do I Need To Register Llc As A Business In Atlanta

If you want to reap the benefits of launching a small business organization in Georgia, you lot'll demand to determine what blazon of business entity structure your visitor should have. Limited liability company (LLC) is a pop structure among small-business owners considering it offers flexibility, tax advantages and simpler requirements than a corporation. This guide explains how to form an LLC in Georgia with pace-by-step instructions.

How to grade an LLC in Georgia

Forming an LLC in Georgia is relatively elementary. You'll demand to register your business organisation with the Georgia secretary of state , who defines the rules and procedures for LLC formation in the state.

Step one: Choose a proper name for your LLC

The first decision y'all'll take to brand its choosing a name for your visitor. You might already have a name in listen or might need to come upward with one from scratch.

Name requirements

The name of your LLC must be distinguishable from other businesses that are registered with the Georgia secretary of state. In addition, the proper noun must finish with one of the following words: express liability company, limited company or the abbreviations LLC, L.50.C., LC or L.C. Yous can abbreviate limited as "Ltd." or "Ltd." and company as "Co" or "Co."

The use of certain words in your company name is prohibited and requires special approval from the state. These include words associated with insurance, banking and education. For instance, you cannot use any of the following words in your LLC's name unless yous have special permission: insurance, surety, bank, trust, college and university. You also can't employ words similar "corporation" or "limited partnership," which might suggest that the company is some other type of business entity.

Georgia's LLC statute allows licensed professionals, like doctors and lawyers, to form LLCs. In some other states, at that place are restrictions on the types of businesses that professionals can starting time, but there'southward no limitation in Georgia. Georgia doesn't recognize the Professional LLC (PLLC) as a legal business construction. Professionals tin, however, course a professional corporation (PC).

Name reservations

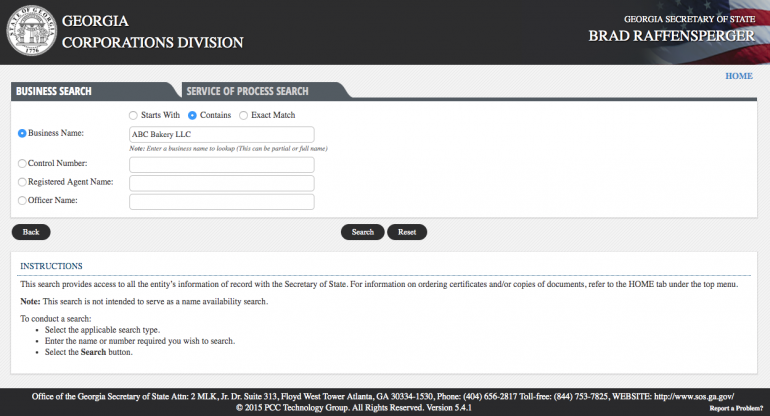

Once you narrow down a name for your business, y'all can caput over to Georgia's business concern search website to see if the proper name is available. If it is, you can reserve the business proper noun for up to 30 days past submitting a proper name reservation request class , either online or by mail. There'southward a $25 fee for name reservation in Georgia.

Proceed in listen that reserving a name doesn't guarantee that the name conforms to trademark laws or federal laws. If yous take any dubiety nigh a name's suitability, information technology's best to consult a lawyer.

Source: Georgia Secretary of State

Step ii: Cull a registered amanuensis in Georgia

The adjacent step to LLC formation is to cull a registered agent for your Georgia LLC. A registered amanuensis is a person or organization that accepts official mail and service of process on your company'due south behalf. If the land or a legal claimant needs to contact yous, they will use the registered amanuensis's address, which is called the registered office.

A member of the LLC tin serve as the registered agent, only for applied purposes, virtually companies apply a business concern chaser or registered amanuensis service. If you use an individual every bit your Georgia LLC's registered agent, they must be a resident of Georgia and available to accept mail during normal business concern hours. Every registered amanuensis must maintain a registered office in Georgia with a concrete address (no P.O. boxes).

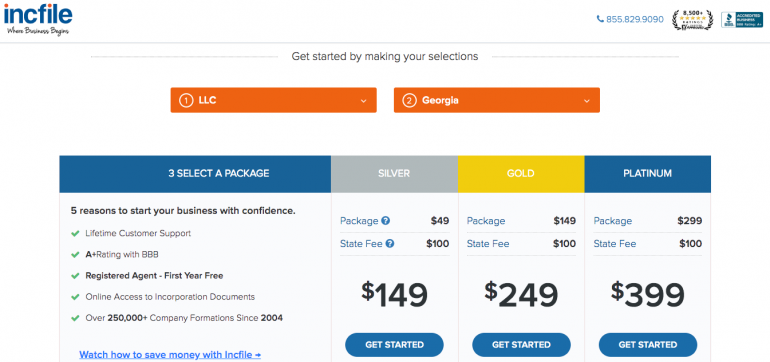

Should you lot demand registered agent service, nosotros recommend Incfile. It volition include one year of free registered agent service with LLC formation.

Pace 3: Obtain Georgia business permits

In society to operate your business in Georgia, you'll demand to obtain a general business concern license from the city or county. Certain professional person industries require special licensing.

Dissimilar many states, Georgia does non require statewide fictitious business name/DBA filings. Nonetheless, if your business operates nether a trade name that's different from your business's legal name (e.1000. Joe'south Baker and Restaurant, LLC operating as Joe's Bakery), then you lot'll need to file a registration argument with your canton's superior court clerk.

Step 4: File articles of organisation and transmittal grade

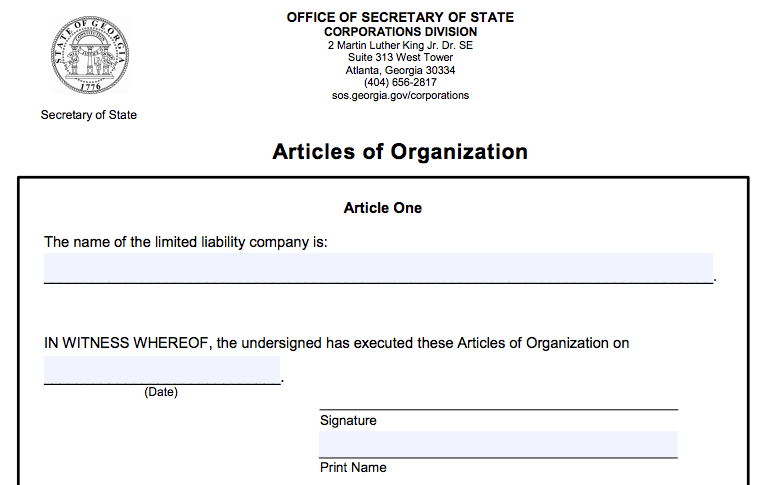

Until you lot file your articles of organization, your Georgia LLC isn't officially gear up up however. The articles of arrangement contain basic formation and contact information for your visitor and authorize your visitor to operate in the country. You can file the articles of organisation online or past postal service, along with a filing fee of $100.

The appropriate form for domestic LLCs — those that are organized under the laws of Georgia — is Form CD 030 . Compared to other states, Georgia's articles of organization document is very brusk. All you lot need to notation downwardly is the LLC'south name and the signature of the person filling out the course. That could be a fellow member, managing director, lawyer for the LLC or another organizer.

Concern owners who cull to submit the manufactures of system by postal service will likewise demand to file a completed transmittal form . The transmittal form contains more information about the company, including the legal proper name, business organisation address, member names and addresses and registered agent data. A transmittal form is non needed if you file your manufactures online.

Your business officially starts on the solar day that the secretary of land receives your articles of organization. The secretary of state will process your filing and post a certificate of organization to your business address within five to seven business days. Occasionally, processing can take up to 12 business concern days.

If you formed an LLC in a different state and now want to operate in Georgia, most of the same rules apply, but you're considered a foreign LLC. In this case, you'll need to fill up out a different course in lieu of the traditional articles of system. This grade is Form 241-Application for Certificate of Authorisation for Strange Express Liability Company . The filing fee for foreign LLCs looking to do business in Georgia is $225.

Source: Georgia Secretary of State

Step v: Draft an LLC operating understanding

Next up on your listing is to create an LLC operating understanding. Although Georgia doesn't require LLCs to take an operating agreement, y'all should consider this an essential pace. An LLC operating understanding lays out the rights, responsibilities and turn a profit and loss shares of each owner in an LLC. Even if you have a single-member LLC, an operating agreement is highly recommended because information technology summarizes the operating procedures of the LLC. This is where you turn to in social club to certificate your meeting schedule, voting rights and revenue enhancement preferences.

Footstep half dozen: Pay taxes, and comply with other country requirements

Taxes for a Georgia LLC depend on how the LLC's members choose to be taxed. By default, LLCs are taxed as sole proprietorships (if unmarried-member) or partnerships (if multi-member), in which case business income and losses are reported on each business organisation possessor's personal revenue enhancement return. Each business organisation owner pays Georgia income taxes on its share of the business profits.

If the LLC chooses to be taxed every bit a corporation, then the LLC will have to pay an annual state corporate tax. LLCs taxed every bit corporations also accept to pay a internet worth tax based on the assets of the visitor.

Remember, it's non just income taxes that a company has to pay. Georgia businesses with employees also should be prepared to pay payroll taxes. The Georgia payroll tax charge per unit currently ranges from 0.04% to 8.1% on the first $9,500 of wages.

Pace 7: File annual registration report

Georgia LLCs must file an annual registration statement with the secretary of state. The purpose of this annual filing is to ensure that your business address, registered agent and registered office information are upwardly to appointment. The annual registration argument is due between Jan. 1 and April 1 of each year (the first statement is due the calendar year following your twelvemonth of formation). You must either file your registration statement online or print a class from the website to mail in. The filing fee for annual registration is $50.

In one case you submit your registration statement, if any relevant business information changes (eastward.one thousand. such equally your registered amanuensis), you must submit an amended annual registration argument with a $20 fee.

Pace 8: Comply with federal requirements

LLCs organized in Georgia must comply not only with land requirements but likewise with federal requirements. For example, LLCs taxed as corporations and whatsoever LLC with employees must utilise for a federal employer identification number (EIN) for taxation purposes.

You'll likewise need to pay federal income taxes and payroll taxes. Federal income taxes differ based on whether the LLC is taxed equally a laissez passer-through entity or corporation. If your LLC is taxed as a pass-through entity, federal police force allows yous to deduct 20% of your LLC's income before paying personal income taxes on whatsoever business organization profits. Corporations are taxed at a flat 21%.

Federal payroll taxes comprehend Social Security and Medicare. LLC members typically have to pay the employer and employee share of these taxes — called self-employment taxes — on any distributions from the business. They also accept to withhold payroll taxes from employees and pay the employer tax on employee wages. Currently, the employer tax for Social Security and Medicare is 7.65%, and the employee tax for Social Security and Medicare is 7.65%.

Advantages and disadvantages of forming an LLC in Georgia

Every state has unlike requirements for forming and maintaining a business organisation. The good news is that you can form your concern in any state, fifty-fifty if information technology's not where your headquarters or chief office is located. Every state allows out-of-country, or "foreign LLCs" to do concern in its state as long as the business pays taxes and complies with other state regulations.

If you lot're planning on forming an LLC in Georgia, evaluate the pros and cons kickoff:

Advantages

-

LLC members bask express personal liability for business debts and obligations.

-

LLCs can cull their tax handling.

-

Online filing is available for all LLC forms in Georgia.

-

An LLC operating agreement isn't legally required in Georgia (though still highly recommended).

-

Georgia has relatively affordable LLC filing fees ($100) and annual registration fees ($50).

Disadvantages

-

Georgia LLCs taxed every bit corporations must pay an almanac corporate tax and internet worth taxation.

-

Georgia payroll taxes are relatively high compared to other states for LLCs with employees.

-

LLCs require more paperwork than a sole proprietorship or general partnership.

-

Information technology's harder to raise investor coin for an LLC, compared to a corporation.

-

The filing fee for strange LLCs in Georgia is relatively loftier ($225).

Source: Incfile

If you need additional guidance, we suggest consulting a concern lawyer or using a business formation service such as Incfile. Starting for just $49 plus state filing fees ($100 in Georgia), Incfile will file all formation paperwork on your behalf, give you lot an electronic copy of the filed paperwork and provide one year of gratis registered agent service. For an boosted fee, Incfile will fifty-fifty draft a custom LLC operating agreement for your company.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Do I Need To Register Llc As A Business In Atlanta,

Source: https://www.nerdwallet.com/article/small-business/llc-georgia

Posted by: earlcuposidere.blogspot.com

0 Response to "Do I Need To Register Llc As A Business In Atlanta"

Post a Comment