How To Register To Sell On Amazon For Foreigners

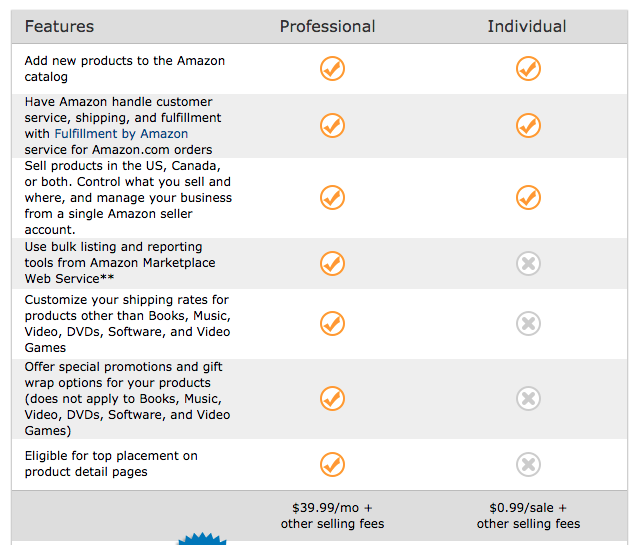

💡 This article was published in 2015. Since and then, nosotros shared new information. Here's a recent post: Amazon offers a huge opportunity for brands selling physical products. The practiced news is that selling on Amazon is not but express to US residents and corporations - it is possible to sell on Amazon in the US without ever setting human foot on U.s.a. soil. This 4-function series will walk through the process of setting up an Amazon Seller Business relationship every bit a greenhorn, likewise as the ins and outs of importing your products, getting paid, and expanding beyond the US. Make sure you sign up to our mailing list to get notified when new articles come out! Notation: I offer this information as a starting indicate. You should always check the rules & regulations in your own country as well as the current information provided by Amazon & the US federal government. You should also consult with a taxation advisor to aid y'all determine the all-time options from a personal tax planning standpoint. The commencement step is to selling on Amazon is to annals for an business relationship. An obvious get-go motility, but what is not so obvious is all the decisions you'll have to brand about how to set your business relationship. The graphic beneath shows the differences betwixt the ii types of accounts yous tin create on Amazon. The Individual Selling Plan is suited to lower-book sellers who will be selling less than 40 units per month. Above 40 units, you may as well be on the Professional Selling Plan and pay the $39.95 monthly fee. You must also be on the Professional person Selling Programme to sell in certain product categories. *Note: this mail service was written in February 10, 2016, and a few things have changed since then! The Professional Selling Plan was updated at 39.99 USD$ per month, in March ane, 2018. This decision related to how you get your products to customers. We're trigger-happy proponents of FBA (Fulfilled by Amazon) and meet information technology as the all-time way to sell 90% of products on Amazon. Customers trust you & your products more than, shipping costs tin can be lower for both yous & the client, and you have the ease of having Amazon shop your inventory and manage orders for you. Here'due south how FBA works as an international seller: All Professional Sellers and those with over 50 transactions in a agenda year must submit their tax information to Amazon. When setting up an business relationship, you'll go through a Taxpayer Wizard which volition generate an IRS tax form for you to complete. Strange sellers still need to consummate the tax interview, and it's likely that the form which is generated for you lot is a W9-BEN course, which means yous'll be exempt from U.S. tax reporting requirements. This is adept news, considering strange persons are not subject area to U.S. income taxation withholding if performing the work outside the U.S. Of course, you may stillhave to pay tax on this income in your own land. And if y'all set upwardly a The states-based corporation or LLC, that entity will exist considered a US "person" and therefore subject to paying income tax. Then the decision to make here is whether to create a business concern entity in the U.s., or maintain condition as a foreign individual. Exist sure to consult a tax professional person to determine the best action in your case. Some product categories require manual approval to sell in. Some of the more popular categories include: *Notation: this post was written in February ten, 2016, and a few things accept changed since then! The post-obit product categories list has been updated in March 1, 2018. Getting blessing in these categories commonly involves demonstrating to Amazon that you lot're a legitimate manufacturer or brand. They desire to ensure that yous have substantial enough business organisation to warrant the effort of reviewing your products and brands, and that you are not at risk of supplying low-quality or defective products. The type of information requested varies, just may include Purchase Orders or Receipts from suppliers and Business Registration documents. See all the product categories and whatsoever selling restrictions right here. To create an account, you'll also need to provide: Stay tuned for Function ii of this serial, where we'll discuss how to go paid for your sales on Amazon; bank accounts; taxes; and selling fees. Don't miss the other parts of this four-role blog series on how to sell on Amazon every bit a non-Usa resident! Function 1: Process for Setting up an Amazon Business relationship as a non-US Resident (this article).

Role one: Process & Requirements for setting up an

Amazon Us / North America AccountDecision 1: Private or Professional Seller

Determination ii: Fulfillment - FBA or Merchant Fulfilled

Related: planning to expand your business organisation to international markets using Amazon? We take only the right thing for yous. Click here to receive access to our dedicated country guides that will teach yous how to get-go selling on Amazon Canada, Frg, United kingdom of great britain and northern ireland and Mexico. Determination iii: Taxpayer status

Getting approval in your product category

Watches Other requirements specific to registering on Amazon U.s.a.

Office 2: Getting paid as a non-Usa Amazon FBA Seller

Part 3: Importing Products to the U.s. to Sell on Amazon

Function 4: Beyond the Amazon America / US Market

How To Register To Sell On Amazon For Foreigners,

Source: https://blog.bobsledmarketing.com/blog/sell-on-amazon-usa-as-a-foreigner-overseas

Posted by: earlcuposidere.blogspot.com

0 Response to "How To Register To Sell On Amazon For Foreigners"

Post a Comment